Agile Retail as a Macrotrend

Removing the barriers that modern consumers commonly face when navigating the retail landscape

Exploring the Agile Retail strategies that brands and retailers are employing to help consumers navigate an industry as boundless as the retail industry

Contents

1.0 FOREWORD

2.0 MICROTRENDS & OTHER AREAS OF AGILE RETAIL

– ON-DEMAND MANUFACTURING

– GUERRILLA MARKETING

– SUBSCRIPTION E-COMMERCE

– MODULARITY

– ONLINE-TO-IN-STORE

– Flexible Payment Options and Last Mile Fulfilment

– POST PURCHASE AND END-OF-LIFE

3.0 OUR PERSPECTIVE

1.0 Foreword

Our Trends and Insight Team intently monitor the retail landscape, researching microtrends and watching their buoyancy in a hyperactive industry to detect their impact on the industry’s future trajectory. Through identifying patterns, correlations, differences, and similarities between several microtrends, it is indeed possible to predict the next macrotrend which will support the future of retail and push it into a new era – as is the case with Agile Retail.

Agile Retail has for some time been widely implemented by brands and retailers to improve business mechanisms – from being better able to react to change and accurately forecast supply and demand, to generating publicity and streamlining operations to reduce costs and increase efficiency. Yet, it is only now that we are seeing brands and retailers fully embrace this approach by using Agile Retail to remove the barriers that modern consumers commonly face when navigating the retail landscape, empowering the consumer in the process.

IN THIS WHITEPAPER…

In this whitepaper we will be identifying the ways in which brands and retailers are demonstrating Agile Retail, exploring microtrends to help us to define the shape of retail in a post-coronavirus world. We will also be observing how the rise in demand for Agile Retail is creating a gap in the market for progressive start-ups as some established companies have been slow to adapt their operations in response to this metamorphic macrotrend.

2.1 On-demand manufacturing

On-demand or cloud manufacturing is a production process which is rapidly gaining traction as a microtrend of Agile Retail, not least for its flexible approach and subsequent benefits to business operations, consumers, and the environment, alike.

Mentioned previously in The Footwear Market whitepaper released last month, a great example of on-demand manufacturing is adidas’ Speedfactory – an intelligent setup which explores small quantity, high-specificity production. Benefiting from better cashflow, easier inventory management, fewer markdowns and less waste, this process of production can significantly reduce retailers’ capital losses.

Another example of a brand using on-demand manufacturing to demonstrate Agile Retail, which we love for its use of AR, is Topology – a company producing on-demand, custom-tailored eyewear. Consumers are invited to use the AR app which generates a 3D model of the customer’s face and allows them to preview a range of glasses on themselves through the app. After purchase, the glasses are made to measure and delivered to the customer in a turnaround of no more than two weeks.

Thus, on-demand production that is reactive to real-time supply and demand often leads to quicker turnaround of orders, more limited edition and exclusive products, more customization/ personalisation options and no minimum order quantity.

We predict that this on-demand trend will rise in popularity in the coming years, not only for its ability to reduce retailers’ impact on the environment, but also because of its ability to satisfy the increasing number of consumers who are seeking exclusivity and that ‘personal-touch’ – a prevalent facet of Agile Retail. Furthermore, in a post-coronavirus world, we suspect that this approach to production will be adopted by a deluge of brands so that they can promptly increase, decrease, or altogether halt production of goods in the case that history repeats itself and they once again must close their doors to the public in the future, or in different circumstances, experience a singular surge in demand.

2.2 Guerrilla Marketing

Omnichannel marketing is commonplace and is, for the best part, written into the marketing strategy of any brand or retailer. Yet as most retailers now deploy this marketing strategy as standard, it is vital that brands and retailers push their marketing further to remain current. Thus, in recent years we have seen a rise in Guerrilla Marketing – a microtrend of Agile Retail which uses the element of surprise or unconventional interactions to engage consumers with the product or brand.

Exploiting the physical channel through Guerrilla Marketing to enhance its function, Reebok’s ‘Are you fast enough?’ marketing campaign challenged passers-by to run at a minimum speed of 17 km/hour past a billboard which had a built-in tracker to measure the speed of passing pedestrians. Upon completing the challenge, the glass showcase opened-up, inviting winners to pick their free pair of Reebok ZPump 2.0 shoes. In putting in the time, effort and capital, Reebok went out of its way to create an experience desired by the consumer of 2020 and was rewarded with enhanced brand engagement, receiving over 275 thousand views on YouTube, over 30 thousand Shares across the social media platforms and news coverage from several outlets.

DROP CULTURE

A popular Guerrilla Marketing technique among brands and retailers is ‘Drop Culture’ – different from most other Guerrilla Marketing techniques as consumers are able to purchase the product, there and then. This type of Guerrilla Marketing is similar in the sense that it creates an impression of exclusivity as the product-drop is often time and stock limited, whilst also offering an element of experience with consumers getting caught up in the hype.

Supreme is famous for its participation in ‘Drop Culture’, surprisingly and unconventionally dropping a limited edition Supreme-branded Honda CRF 250R off-road dirt bike just last summer as part of its autumn/winter collection. Appealing to consumers who cannot travel far for ‘drops’, Supreme released its collection in key stores across its international estate so consumers can anticipate that some drops will be closer to home than others.

Through this type of physical marketing, brands and retailers can satisfy at least two characteristics of Agile Retail – creating that personal-touch and sense of experience for consumers – contributing to a portfolio of microtrends that make up a symbiotic Agile Retail ecosystem.

GOING FORWARD

Post-coronavirus, we predict that, much like the Adverts on TV at Christmas, there will be an appreciation of rivalry between brands as marketing campaigns drop simultaneously, including those that were organised before confinement (but not yet launched) and those being planned currently in an attempt to reconnect with the customers they may have lost-touch with over previous weeks. We also imagine that some brands and retailers will explore how the same impact of guerrilla marketing in the physical realm can be achieved via online channels in preparation for such an unforeseen scenario where the public must social distance in the future once more.

2.3 Subscription e-commerce

Subscription e-commerce has grown by 100% in the last five years for its obvious response to Agile Retail as a macrotrend. It is a business model which can offer more accurate forecasting and the opportunity to effectively level out supply and demand – cutting down production waste in the process. Empowering the customer, not only does subscription e-commerce reduce the amount of time spent on purchasing recurring, and often essential, items, but it also awards peace of mind.

Yet, many established brands and retailers have been slow to introduce this business model, despite its rise in popularity, making room for start-ups to capitalise on this highly successful microtrend. As a result of the social distancing measures imposed by governments in response to COVID-19, Tails.com – a company set up in 2013 offering the delivery of tailor-made dog and cat food on subscription – has seen a boom in sign-ups. Indeed, whilst other establishments selling pet food have experienced shortages on their shelves and in their warehouses as a consequence of panic/bulk buying, Tails.com has been able to maintain and offer a steady supply of pet food to devoted pet owners through its subscription e-commerce model.

However, whilst subscription e-commerce has experienced something of a boom in recent weeks, it has been gaining traction in its own right long before. Dollar Shave Club – a company that uses subscription e-commerce to provide recurring deliveries of razors and other grooming products to its members – has seen subscriber gains at a rate of +10% year on year. Using online influencers to promote its brand, its direct-to-consumer subscription e-commerce model offers the convenience of routine deliveries and lower prices in comparison to similar products sold by third-party retailers.

With DNVBs growing three times faster as a result of their ‘direct-to-consumer’ structure and subscription e-commerce growing by 100% in the last five years, these business models, which perfectly demonstrate Agile Retail, are proving to be successful pioneers in the retail sphere and we anticipate that in a further five years this model will be customary to retail.

2.4 Modularity

MODULAR STORES

Modular stores composed of standardised units have the ability to be flexible in the sense that the units are commutable, customizable, and can be substituted at any given time. Making it possible for brands and retailers to change their store designs, quickly, easily and with little cost, modular stores can seamlessly and regularly provide brand-fans with more refreshed store concepts and physical retail experiences than ‘fixed’ store interiors over the same period of time.

Launching a new modular store concept, Schuh has transformed some of their stores, which are typically linear in layout in order to be horizontally fluid – allowing for the seamless reconfiguration of categories to respond more effectively to sector trends. This new store concept is not only multi-functional and digitally purposeful, but it is also a platform and home for brands to express themselves.

Similarly, A.P.C. uses modular fixtures to create flexible retail environments. However, it does not only move its modular mistral systems within its stores, but indeed, in and out of stores across its estate for purpose of exclusivity. Creating an architect’s dream with a store design that is perhaps more reflective of an art gallery than a store, A.P.C. fans are anticipating where this store design concept by Laurent Deroo Architecte, complete contemporary mistral modules, will pop-up next.

POP-UPS

Stepping away from permanent concessions and taking modularity further is the use of temporary pop-ups – a popular trend used largely in the beauty sector. Recognising that consumers’ desire experiential retail, beauty pop-ups not only typically travel far and wide to key shopping locations, but many also offer a retail experience at these locations, often in the form of giving makeovers to beauty fanatics.

A veteran in pop-ups, Charlotte Tilbury frequently deploy pop-ups to highlight new product releases or campaign launches to create a sense of hype and bring the new product and/or campaign closer to the doorsteps of brand-fans. From Pillow Talk to Hollywood Lips, its pop-ups are often further accompanied by stunning window displays and captivating launch zones occupying key shopping locations where its consumer-base resides.

IDENTIFYING WITH THE INCLINATIONS OF THE MODERN CONSUMER

Not only is modular design a cost-effective method in the long-run for brands and retailers who wish to change their store design concepts regularly, but retail concepts that can travel among several shopping locations are better able to respond to the needs of time-poor consumers who cannot travel far to enjoy each concept revision or campaign launch of their most-loved brands. Not to mention that modular design is also better for the environment with reduced fixture waste, identifying with the inclinations of the modern consumer.

Once the current lockdown is lifted, we depict that there will be a rise in the number of travelling pop-ups in key shopping locations as brands celebrate the end of confinement with their consumer-base. For those retailers that were permitted to keep their doors open during confinement to provide the public with essential items, we suspect will move to a more modular store concept so that they can stock and display essential and/or highly sought out items more intelligently on the shop floor in the future. Since there will still be a great amount of social distancing that will need to be respected, even after governments lift the confinement measures, we also imagine that brands and retailers will implement something of a ‘social distancing toolkit’ alongside their current store layout, composed of modular fixtures and fittings to promote social distancing.

2.5 Online-to-in-store

Agile Retail is something of an evolution of omnichannel retail, with Agile Retail engaging the microtrends which exploit the channels and maximise their function. Thus, even successful DNVBs are now seeing value in becoming omnichannel retailers if it means that they can better implement a fully comprehensive Agile Retail ecosystem desired by the consumer of 2020. However, many DNVBs are still finding ways to maintain their online identity by creating strong links between their physical concession and online store.

Amazon’s 4 Star Store, for example, is a concept built on consumers’ online shopping behaviour with products that have achieved 4 Stars or more on its online store determining the stock of its physical store. Likewise, Neighborhood Goods is a concept which invites online stores to borrow physical space to display their customarily online-only products in a physical retail environment, without the large overheads or commitments of a permanent concession. Using technology to track customer demographics, sales and customer journey, Neighborhood Goods provides these ordinarily ‘online-only’ brands with a weekly report so that they can measure the success of this physical channel in the same way that they can with their online platforms. Through leveraging this data, brands and retailers can swiftly and continually improve upon their physical retail activities and enhance their overall conduct on this channel.

INSTORE TECHNOLOGY

Many brands and retailers invest in enhanced digital retail experiences within the physical realm, not least in an attempt to bridge the gap between online and offline but also to create a retail experience which offers the best of both worlds – the efficiency of online with the experience of offline – to provide a model that truly works for the modern-day consumer requiring an assemblage of retail variants.

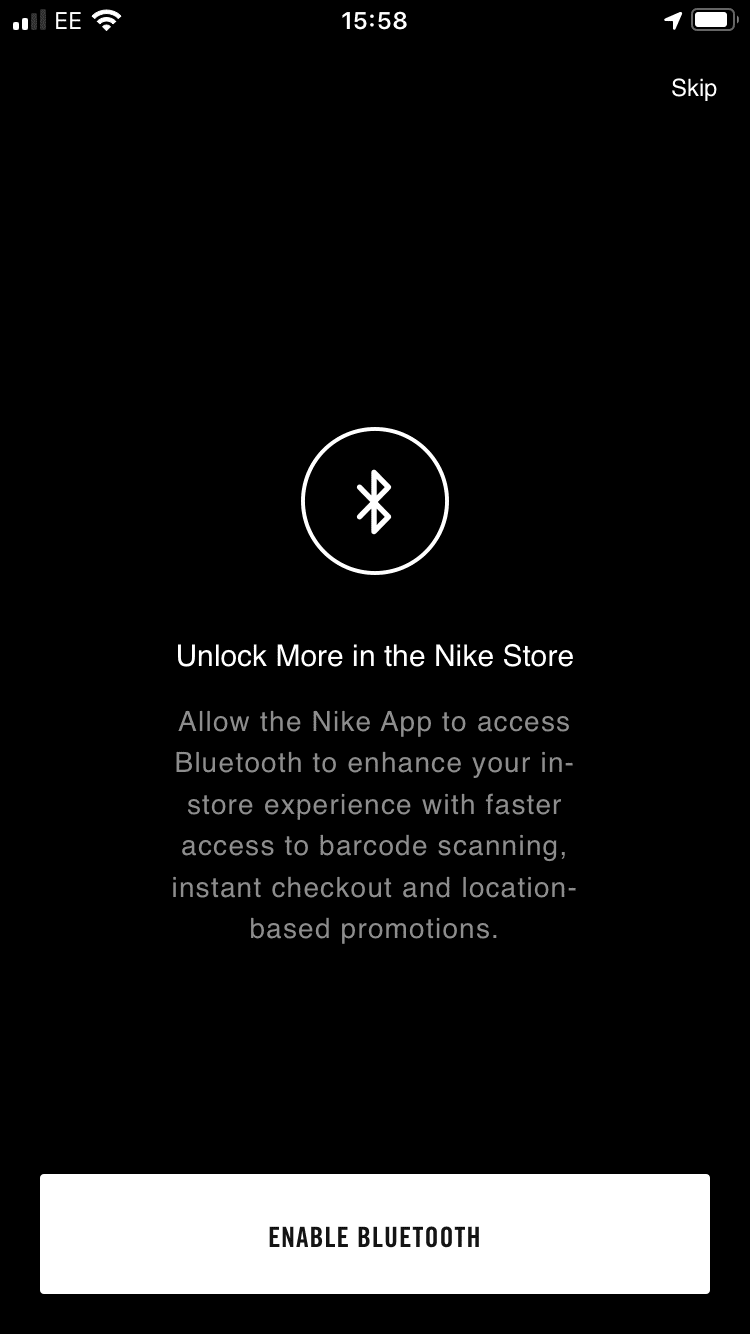

Nike uses a plethora of instore technology in its flagship stores to create a more cohesive online-to-in-store experience and respond to consumers’ desire for Agile Retail, including a more streamlined physical retail experience than is currently offered as standard. Using the Nike App, customers are given exclusive access to an enhanced and more streamlined shopping journey which includes the ability to reserve shoes on the app and try them on in-store. Once reserved, the shoes are sent to in-store lockers which can be found through the app using beacon technology and unlocked via the smart phone. Additionally, consumers can use the ‘shop the look’ feature on the Nike App allowing them to scan the QR code on in-store mannequins to call-up product details and sizes of the respective items. Adding these items to a ‘try-on list’ will trigger store staff to deliver the items to one of the fitting rooms, instore.

BEST OF BOTH WORLDS

Creating a more cohesive online-to-in-store experience is vital for brands and retailers as consumers already convolute the two channels, with figures suggesting that 64% of consumers who buy online start their buying journey in-store. With brands and retailers barely scratching the surface, we anticipate that there will be an explosion of innovation in the years to come in relation to brands and retailers creating a more cohesive online-to-in-store experience using instore technology or otherwise. Post-coronavirus, we suspect that there will be a rise in consumers using automated in-store processes which can be triggered by apps on their smart phones to exercise an aspect of social distancing whilst enjoying some of the benefits that physical retail has to offer – from its experiential elements to its ability to provide instant gratification as consumers obtain items immediately after purchase.

2.6 Flexible Payment & The Last Mile

Research suggests that the online cart abandonment rate sits at 74.58% (SaleCycle) which is why it is so important that brands and retailers make this process as seamless and convenient as possible, offering omnichannel purchasing and several last mile fulfilment options to suit the multiplicity of buying preferences of the public – from Buy Online Pickup In Store (BOPIS) and Buy Online For Home Delivery, to Standard In-Store Purchase and Shop In Store For Home Delivery.

FLEXIBLE PAYMENT OPTIONS

The choice of methods for completing a transaction in the last mile is already vast, yet it is an area in which we are still seeing innovations – contributing to a portfolio of microtrends supportive of Agile Retail.

An early Agile Retail transaction approach which has been about for some time is the ability to pay for petrol/diesel at the pump as opposed to consumers having to visit a manned till. Whilst not commonplace, this flexible payment mechanism is preferred by 63% of people (digipay.guru) for its obvious benefits of being more streamlined, and thus, more time-efficient, which is invaluable to the many consumers who typically tie-in filling up their tanks with their commute to work.

Rivalling ApplePay’s smart phone and smart watch technology, British start-up, McLear, has since created a Smart Ring so that payment can be made simply at the touch of a finger. A concept once only entertained by sci-fi, this streamlined process of making a payment could not be any more unobtrusive.

Moreover, it is not just the moment of purchase that is evolving to engage Agile Retail, but also the choice of currency that consumers can use, with Bitcoin and other crypto currencies being accepted at an increasing number of retailers with the world’s largest coffee shop chain, Starbucks, looking to accept this form of payment by July 2020.

Brands and retailers who use evolved payment methods and accept new-fangled currencies not only sympathise with consumers requiring a more streamlined shopping journey but those who embrace ‘newism’ – the desire to have the latest things – contributing to a brand’s perceived position in the market in relation to its modernity compared to industry peers.

LAST MILE FULFILMENT

For most online shoppers, home delivery is still the default option of last mile fulfilment, which is perhaps why even fast food delivery has seen a rise in popularity in recent years with forecasts predicting that it will grow by a further 51% by 2021. Anticipating this growth is Chic-A-Filet, a popular restaurant chain in the US that has opened up a handful of ‘kitchen-only’ locations to meet this demand of the future.

Reports also suggest, however, that millennials are more likely to try and trust alternative methods of last mile fulfilment, such as Click & Collect which Box by Posti has evolved to not only provide a location for consumers to pick up their parcels, but offer changing rooms and facilities for unboxing and recycling packaging alongside the collection counter. The rise of Click & Collect fulfilment across multiple sectors indicates that modern day consumers are looking for a half-way house between the convenience of home delivery and the instant gratification of receiving goods quickly.

When retailers are once again permitted to open their doors to the public, we will likely see a sharp drop in the number of people using home delivery services and a rise in the number of people using BOPIS as a compromise between enjoying the freedom of physical retail whilst still exerting reduced social contact compared to standard in-store ordering and purchasing.

2.7 Post purchase

Since consumer returns rights prevent brands and retailers from cutting all ties with the consumer immediately after purchase, there is yet more opportunity for brands and retailers to demonstrate Agile Retail, not least with regard to customer service and returns procedures. In fact, some brands and retailers even assume responsibility for a long time after in the form of aftercare and sensible disposal of products at the end of their life.

AFTERCARE

Lifestyle brand, EastPak, which designs, develops, manufactures and sells bags, backpacks, travel gear and accessories, is a great example of a brand which has a generous aftercare and returns policy. Covering consumers for no fewer than 30 years, EastPak’s warranty offers unlimited free bag reparations or replacements during this time. This aftercare service is not just better for the environment as it will repair items when and where it can rather than disposing of them by default, but its accommodation also demonstrates its commitment to putting the customer at the forefront of its business operations in comparison to many other brands.

IN A CIRCULAR ECONOMY, THERE IS NO END-OF-LIFE

With estimates that 63 million kilograms of clothing alone ending up in UK landfill each year, according to the Waste and Resources Action Programme (WRAP), some fashion brands and retailers have assumed responsibility for items at the end of their lives by implemented schemes that invite consumers to return their clothes for responsible disposal.

H&M is one of a growing number of fashion retailers that has implemented this scheme, collecting over 17,771 tonnes of textiles since 2013 when its Garment Collection Programme was first launched. Quite impressively, the retailer boasts that 0% of the clothes it collects goes into landfill, with items either being recycled, reused or reworn in an attempt to create a more circular economy. Moreover, giving consumers the opportunity to return unwanted clothes at a location where they can buy replacement clothing saves on both time and miles.

In fact, some start-ups have capitalised on consumers’ unwanted clothes by opening second-hand clothing stores – a market which is expected to grow to $51 billion in the next five years. Successful retailers all involved in the resale of second-hand goods include Thredup, Stockx, The RealReal and Pantagonia, among a few. The aforementioned brands and retailers demonstrate Agile Retail with regard to their display of compassion to the environment – identifying with the inclinations of the modern consumer. Additionally, consumers can also very often benefit from lower prices and the opportunity to unearth rare garments at second-hand stores, desirable to those who seek exclusivity and aspire to express uniqueness in their look.

POST-CONFINEMENT

Brands and retailers that provide over-and-above post-purchase aftercare services, in general, are better able to remain in-touch with their customers. Remaining in-touch with customers will be vital in a post-coronavirus world as this ability to reconnect with customers will be a significant factor in how quickly brands and retailers are able to bounce-back from this disruption in the months that follow. Predicting the short term trajectory of second-hand retail once current restrictions have been lifted, we expect that retail will, as a rule, be back with boom as consumers who have curbed their buying in recent weeks consume over and above, across the sectors. Indeed, some may even express their newfound freedom in the clothes that they wear, increasing demand for those one-of-a-kind garments. Socio-economic factors are also likely to play a part in the short to mid-term trajectory of second-hand retailers, post-confinement, as those who have experienced job losses at this time will be more inclined to buy cheaper garments that can often found at second-hand shops.

3.0 Our perspective

With all this said, in a post-coronavirus world, brands and retailers will be put to the test in how well they can implement Agile Retail strategies which put the wellbeing of their customers and their staff first. Thus, among implementing and leveraging existing practices and technologies to demonstrate Agile Retail strategies that promote social distancing, we will also likely see the addition of Social Distancing Toolkits in the form of fixtures, fittings and graphics written into the design and layout of stores – at least until a vaccine is made, the virus diminishes in line with seasonal changes, or more drastically, herd immunity is achieved.

However, in order for a brand or retailer to offer agile retail as standard to its customers, it must be written into the very foundations of its business and at the forefront of everything it does. More than just a reactive operation, companies that exercise this Agile Retail mindset are typically better able to respond to consumers’ changing needs, not least because their operations are set up to anticipate changes and trends as opposed to chasing them at the expense of other business goals.

Those brands and retailers that embrace Agile Retail as a macrotrend and adopt a comprehensive Agile Retail ecosystem, we predict, will move forward into a new era of retail. Whilst those who are slow to adopt this holistic approach to retail which empowers the customer will be expeditiously superseded by progressive start-ups, as we have already observed.

Request the full article

"*" indicates required fields